It’s nice being a freelancer. Otherwise, 55 million Americans wouldn’t choose it. No traffic jams, the ability to start your day later than others, going on a holiday without asking your boss for permission first, and so on.

Yes, freelancing does sounds like a dream job. But only until you truly get into it and start seeing the reality of a freelancing budget.

Then you realize that your income is irregular, you don’t have a retirement fund and you are now responsible for your own health insurance. You even have to play an accountant and deduct your own taxes.

In other words, your freelance budget may have many more expenses than you anticipate — less than your projected income in fact.

Many freelancers give up when they first face these problems and run back to what they believe are more steady 9-5 jobs.

Of course, with that, they also lose some of the control over their lives, but as long as that paycheck comes in every month, for them, it’s a good trade-off.

But for those who are not deterred by these fears and want to keep on freelancing, here are some tips on how to keep your freelancing budget on a tight leash.

Related reading: 7 Powerful Strategies for Getting Recurring Income as a Freelancer

1. What are you spending?

You want to spend less than what you earn, naturally.

However, it’s hard to do that if you don’t know where your money is going.

So sit down, take a pen and start jotting down every little thing that you spent money on this month.

Or, if you’re more than a pen and paper, there are plenty of financial apps that can help you out with this, such as You Need a Budget. (Just make sure you include the app’s price as well. It’s $5/month or $50/year).

You don’t have to come up with an exact figure. Something is bound to slip away, so an average estimate of your monthly spending should be fine. The most important items to include are food, mortgages, utility bills, credit card debts, retirement, phone, internet, medical bills, transportation (even if you don’t have to drive to work, you’ll still travel somewhere) and, of course, taxes.

Now, this last item, taxes, is where most people get stuck. You have to deduct yourself how much you’ll need to pay in taxes. The rule of thumb is to go with 30 percent of your income, but you should get help from a tax professional to get the exact figure for your taxes.

With this as your base, it’s time to see if your income is enough to cover your expenses. For this, you’ll need to create two budgets – a baseline one, based on what you are already spending, and a dream budget.

Related reading: Freelance Finances – Manage Your Income Like A Thriving Artist

2. What is your average budget?

Your average budget should only include the really necessary expenses. You can also call it your baseline budget. This will tell you how far you can stretch based on what you earn.

Take your earnings for the last three months. For example, if you earned $4,000 in July, $3,500 in October and $4,200 in September, this comes to an average of $3,900. This will be your spending limit.

Now deduct the 30 percent for taxes, which in this case would be $1,300, and you are left with $2,600 to spend the next month.

3. What is your survival budget?

Let’s talk about worst-case scenarios. The above freelancing budget should give you a ballpark estimate on how much you can spend in average if everything stays the same.

But what if one client leaves in mid-August? Automatically, you won’t be able to count on this freelance income anymore.

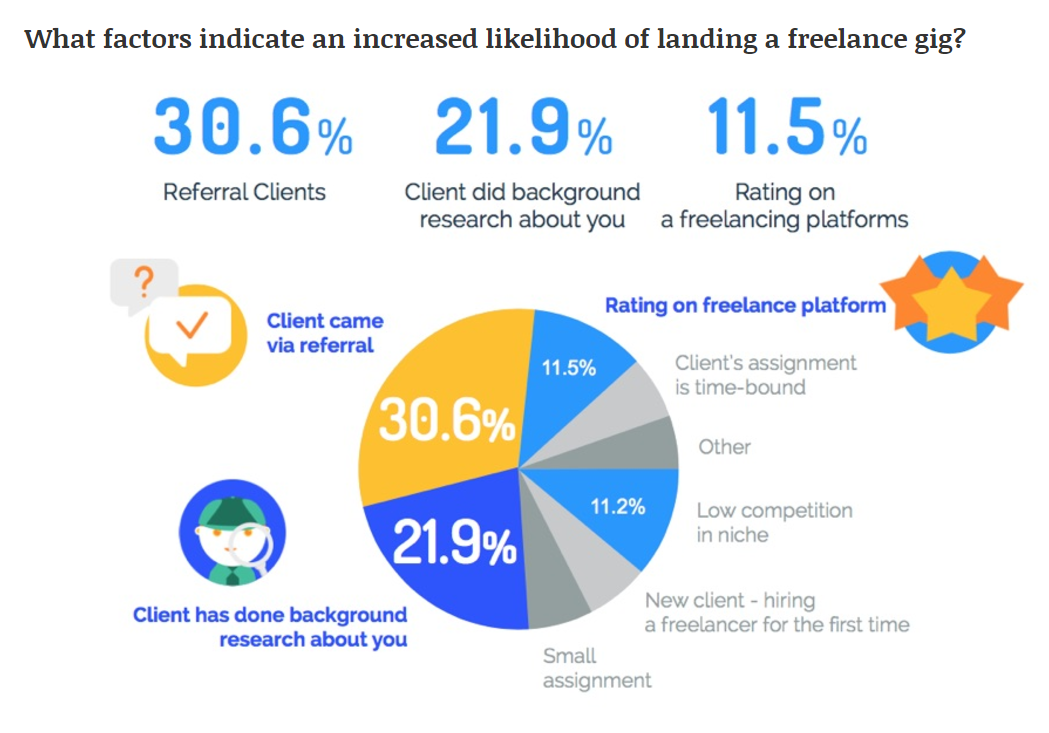

Any freelancer can tell you, getting a new client can be a tough process and there are many variables that can determine if you’ll get a job or not. According to Hubstaff’s 2017 Freelancing Trends: Insights on Finding Clients, Setting Rates, and Landing Gigs, 30.6 percent of clients will hire a freelancer if someone referred them to you, 21.9 percent if they like your background and, very interestingly, 11.5 percent based on your ratings on freelance platforms like Upwork, Hubstaff Talent or some other website.

*Image by Hubstaff.

So what happens if your income can’t cover your costs? If that’s the case, look at where you can cut down those costs.

Do you really go to the gym so often? If not, perhaps working out at home or running would do? What about your mobile phone plan? Do you really manage to spend all your minutes, texts and Internet or do you have a surplus left at the end of every month? If so, perhaps you should start thinking about another, cheaper plan. Also, what do you spend on food? Are you having fancy wines for lunch or ice cream every evening?

Perhaps it’s time to cut down on your expenses a little. Individually, all of these will look insignificant, but together, if you can save a hundred bucks, that’s already $1,200 more that you’ll have that year.

4. Are you paying your employee?

In the end, in a solo business, you are the employee, and you can’t forget to pay yourself, preferably with a regular payday.

This can be once per month or, if you are more used to split payments, bi-monthly or weekly.

For instance, you can base your paycheck on when your bills are due (that’s usually at the end of the months) and when your bigger clients are paying. For me that’s between 20th and the 30/31st. So that’s when I pay myself.

A freelancing business starts with a freelancing budget

Keeping control of your freelancing budget can be difficult at first until you get your freelance business established, but nobody else will do it for you.

However, budgeting is an important part of being a freelancer and by having a clearer picture; you’ll have more right to call yourself your own boss.

How are you handling your budget? Tell us about your methods in the comments below.